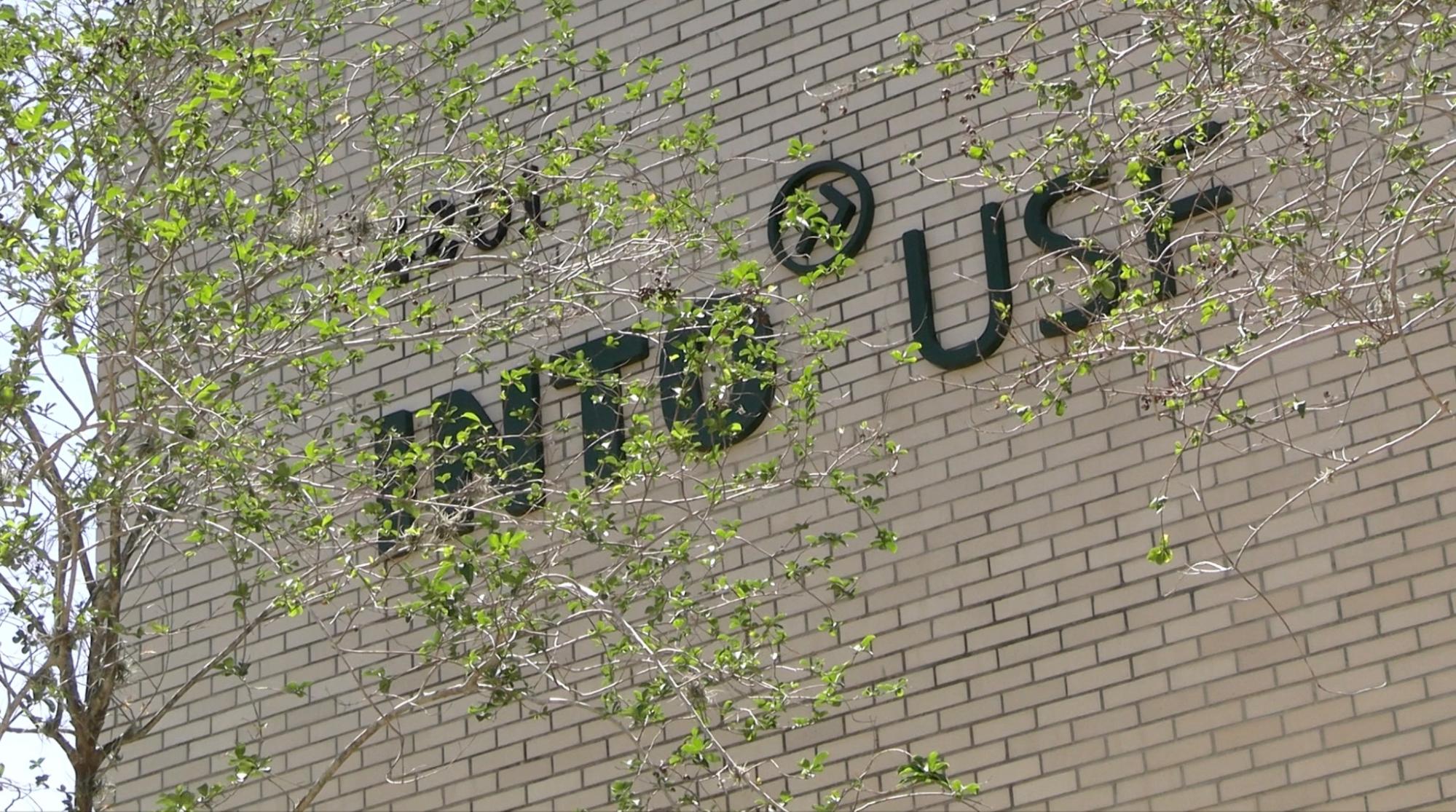

INTO USF reportedly closing, faces lawsuit for investment losses

USF’s Financing Corporation (USFFC) and the USF Board of Trustees (BOT) will attend another lawsuit hearing on May 10 at 2:30 p.m. against defendant INTO USF, according to Hillsborough County’s Clerk of Court’s records.

USFFC and the BOT sued back in July for losses on their investment in equity in INTO USF.

As the case moved through the circuit court, it consolidated with a case filed by INTO USF against the BOT and USFFC due to breach of contract filed on August 10, 2022.

INTO USF is a joint venture between INTO University Partnerships and USF that guarantees progression into undergraduate and graduate courses for international students. The organization supports international students as they transition to the “educational, social, and cultural” norms in the U.S., according to INTO USF’s webpage.

The program was established in 2010 at the university. At the time, it was INTO University Partnerships’ 10th partnership, according to the INTO USF webpage.

The university terminated its “agreements” with INTO USF, according to a USF Board of Trustees’ Finance Committee meeting agenda, on Aug. 10, 2022. BOT and USFFC seek to end their contract with INTO USF as it is no longer profitable. By terminating their agreement, BOT limited the equity losses to the initial investment amount, which resulted in a financially positive change.

Vice President of Business and Finance and Deputy Chief Financial Officer (CFO) Jennifer Condon, Regional Chancellor of USF Sarasota-Manatee Karen Holbrook, CFO Nick Trivunoch and former Provost Ralph Wilcox were summoned on Sept. 21, 2022 as defendants. These individuals are a part of the joint-venture board that oversees INTO USF.

INTO’s nonoperating expenses, which are the costs incurred by a business that are not directly related to the main operations, were reported to be approximately $12.9 million in fiscal year 2021. This reflected a decrease of approximately $2.4 million – or 23% – from fiscal year 2020, according to USFFC’s financial statement for the fiscal year July 1, 2021 ending on June 30, 2022.

Data from the USFFC’s 2021 financial statement found that the decrease in nonoperating expenses primarily reflects the decrease in the equity investment, or the investments an ownership interest will make usually in the form of stocks or shares, in INTO USF.

“The fiscal year 2021 decrease in net position of approximately $1.5 million was primarily related to the decrease in the equity investment in INTO USF due to the cumulative net losses incurred by INTO USF at June 30, 2021,” the report stated.

INTO USF will be closing soon and is not accepting new students, according to an April 21 email sent to The Oracle from former director of marketing and recruitment of INTO USF Margarita Parker.

A closure date for the program was not specified at the time of publication.

A current employee of INTO USF, who wished to remain anonymous, said they are unsure of the organization’s future at USF.

“We’re no longer going to work with USF… We’re still going to assist international students. I just don’t know exactly what we’re going to become,” they said.

USF has not removed any INTO information from the university’s website. INTO University Partnerships has removed all information about the INTO program at USF on their website.